Should Your Benefits Plan Cover Weight-Loss Drugs Like Ozempic?

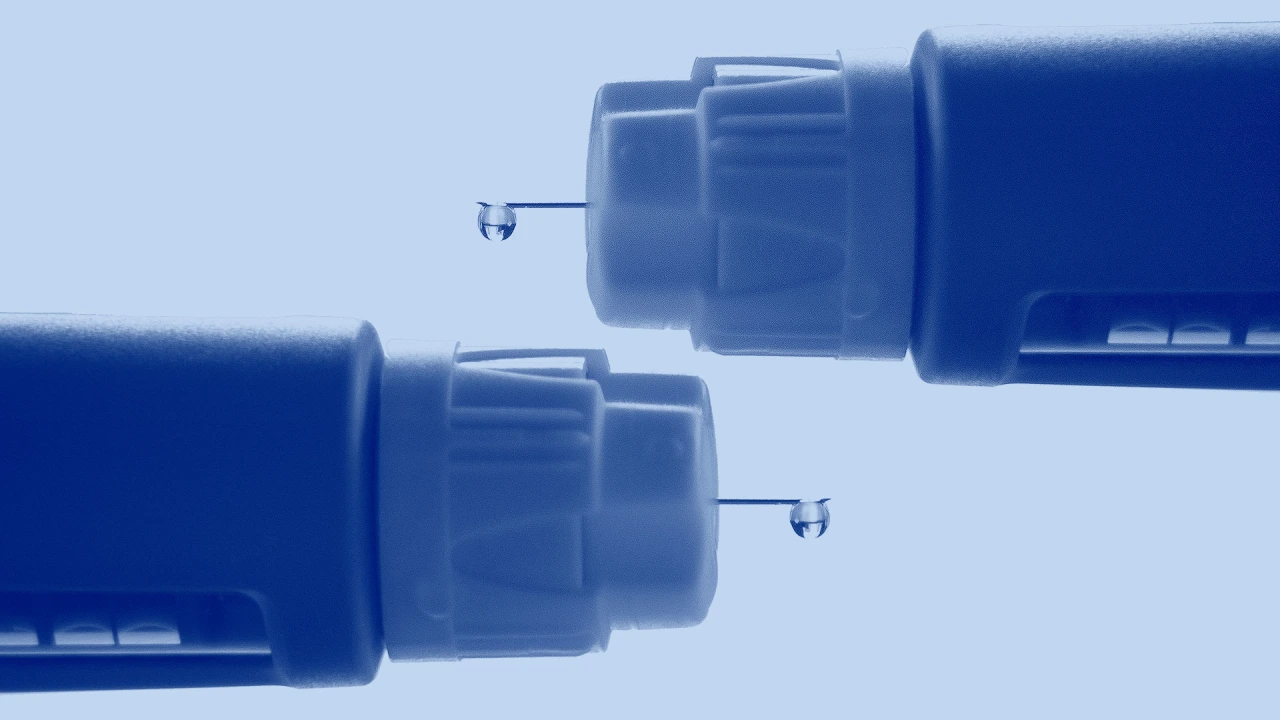

Many people have turned to GLP-1 drugs like Ozempic for weight loss. But who's going to pay for it?

Originally posted on Inc.com by Brit Morse

While many employer plans cover the weight-loss drug Ozempic as a diabetes treatment, only 22 percent of U.S. employers cover any kind of prescription drugs for weight loss, according to a survey from the International Foundation of Employee Benefit Plans, a nonprofit membership organization that provides information for those working in the employee benefits industry.

That could change soon.

On August 9, 2023, Wegovy drugmaker Novo Nordisk reported the results of a new study that showed once-weekly Wegovy injections cut the likelihood of serious cardiac events such as heart attacks, strokes, and cardiovascular deaths by nearly 20 percent--and analysts say a proven heart-health benefit beyond weight loss could increase pressure on more U.S. employers and insurers to pay for Wegovy and similar weight-loss drugs.

"The results [of the study] could improve the willingness to pay for obesity drugs and provide a higher incentive to treat obesity at an earlier stage," Henrik Hallengreen Laustsen, an analyst at Jyske Bank, told Reuters.

Given that more than 70 percent of adults in the U.S. are considered overweight or obese, according to the Centers for Disease Control and Prevention, there's a great need for glucagon-like peptide-1 (GLP-1) drugs that suppress food cravings and improve blood sugar. Being overweight--not just obese--is associated with some leading causes of death, including heart disease, stroke, and diabetes, and is linked to an increased risk of certain types of cancer, the CDC notes. As such, the FDA recommends drugs like Wegovy be prescribed to patients with a BMI higher than 29--the official threshold for clinical obesity--or to patients with a BMI higher than 27, and also suffering from other risk factors such as diabetes, heart disease, or high cholesterol.

And unhealthy employees become expensive employees, notes Nelly Rose, vice president of pharmacy at NFP, a benefits provider, as patients are likely going to have to be on more expensive medications or have surgery if they continue to gain weight, which could end up costing even more in the long run than a prescription for GLP-1 drugs like Wegovy.

"The majority of employers want to provide weight-loss drugs," says Mary Delaney, population health practice leader at Alera Group, an insurance and financial services firm. But that's becoming increasingly difficult, she says, due in part to the fact that nearly half of the people filling such medications do not have diabetes or severe weight issues, leading to massive cost increases to employers' health plans. "They just have to figure out what makes most sense from a cost efficiency perspective," she adds.

If your business is unable to cover the costs of GLP-1 drugs, the next best thing may be offering a reimbursement plan or stipend through a health savings account (HSA), says Rose. Should employees choose to opt in to such a plan, they can use tax-advantaged funds for anything health care-related, including weight-loss medication not covered under insurance.

If you do choose to cover GLP-1 drugs, or any drug with such high off-label utilization, you'll want to bring in some outside clinical oversight in the form of a pharmacy benefits manager (PBM). PBMs are companies that manage prescription drug benefits on behalf of health insurers, some Medicare drug plans, large employers, and other payers. PBMs administer prescription drug plans for more than 275 million Americans who have health insurance from a variety of sponsors including: commercial health plans, self-insured employer plans, union plans, Medicare Part D plans, the Federal Employees Health Benefits Program (FEHBP), state government employee plans, managed Medicaid plans, and others.

PBMs can help ensure requested medical documentation and clinical criteria are used to justify that medications are being used appropriately, says Eileen Pincay, vice president and national pharmacy practice leader at Segal, a benefits consulting firm. "If a plan doesn't cover these drugs, employers are going to see a lot of off-label use, so it's imperative to put in a prior authorization or some type of management to help mitigate that."

The cost to hire a PMB will depend on the contract that is negotiated (discounts, rebates, etc.) and all contracts will vary. That said, regardless of the price, recent studies show such companies can help companies save greatly on overall costs. Pharmacy benefit managers save patients and payers an average of $1,040 per person per year, according to research from pharmacy consulting solution Visante and commissioned by the Pharmaceutical Care Management Association. It also found that PBMs can save payers and patients 40 to 50 percent on their annual drug and related medical costs compared with what they would have spent without PBMs.

While many pharmacy benefit managers do offer utilization strategies around this medication, Pincay notes, hiring a consultant to provide another opinion is also a good idea, especially as regulations around the drugs will likely change in upcoming years.

A pharmacy benefit manager can also help you stay compliant with discrimination laws. While the Americans With Disabilities Act (ADA) protects most job applicants and employees from discrimination, harassment, or retaliation based on disability, employees can still be fired for being overweight in most areas in the U.S.--though some federal district courts, and many state courts, including Michigan's and Washington's, have held that obesity is a disability even absent evidence of an underlying health condition. Massachusetts, New York, New Jersey, and Vermont are also considering legislation to prohibit weight discrimination, and cities including New York City, San Francisco, and Santa Cruz, California, prohibit weight bias at work. Rose advises employers in jurisdictions where obesity may be considered a disability to review their disability-related policies and verify that their job descriptions accurately reflect the physical requirements of each position.